Ranking by profit

The 10 biggest profit makers include six banking institutions

This year, the ten biggest profit makers are: MCB Group, CIEL, Alteo Limited, SBM Holdings Ltd, Absa Bank (Mauritius) Ltd, The Mauritius Civil Service Mutual Aid Association Ltd, Investec Bank (Mauritius) Ltd, Standard Chartered Bank (Mauritius) Ltd, Larsen & Toubro and AfrAsia Bank Limited. Six banking institutions – compared to five last year – are ranked in the top 10 biggest profit makers.

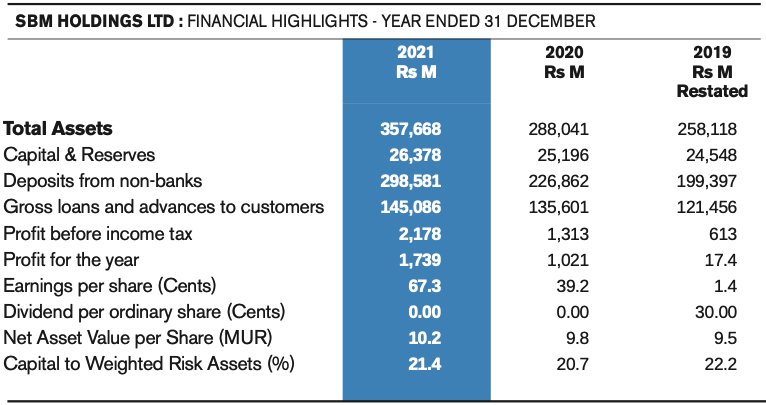

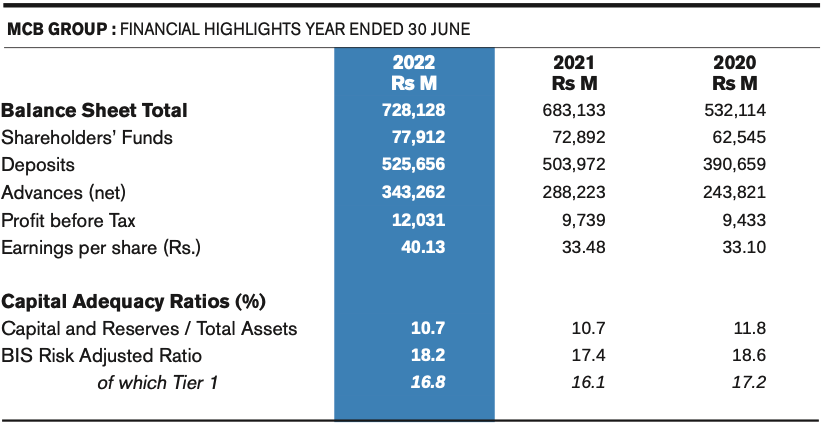

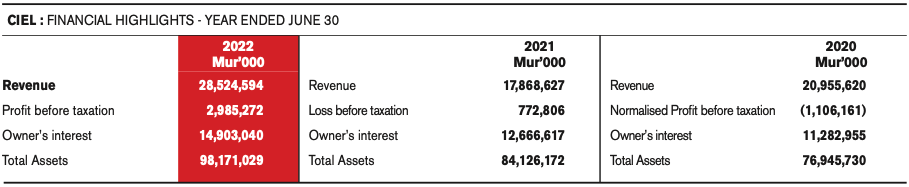

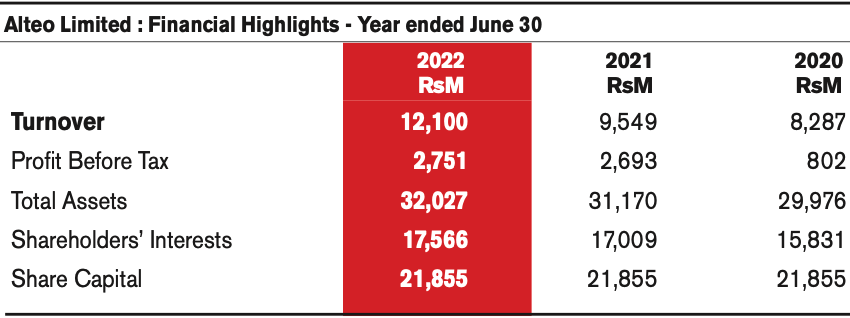

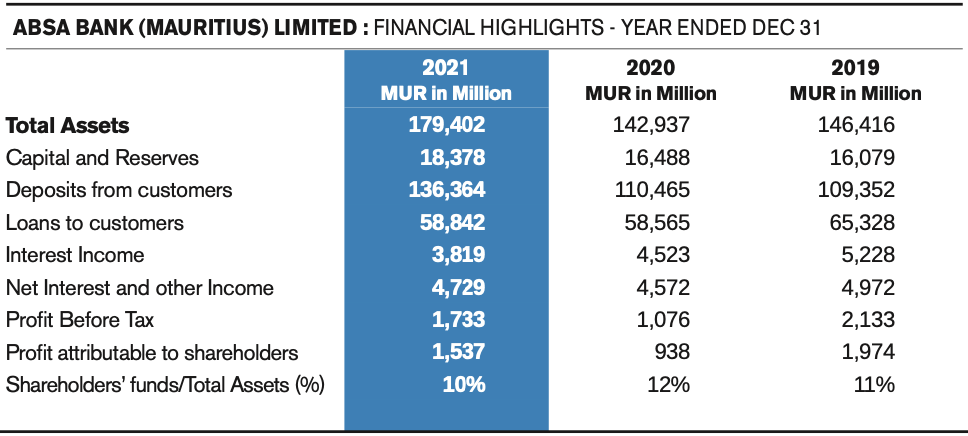

MCB Group registered profit before tax of Rs 12.03 billion (increase of 26.8 per cent). CIEL, which was at the 9th position in last year’s ranking, secured the 2nd place this year with profit before tax reaching Rs 2.95 billion compared to Rs 772 million the previous year. Alteo Limited with profit before tax of 2.75 billion found itself at the 3rd place (8th place in last year’s ranking. SBM Holdings Ltd lost one place (4th in this present ranking) with profit before tax reaching Rs 2.17 billion, an increase of 65.8 per cent. Absa Bank (Mauritius), which was ranked at the 6th position last year, made its way to the 5th place with improved profit before tax of Rs 1.73 billion (increase of 61 per cent).

The 10 biggest profit makers include six banking institutions

This year, the ten biggest profit makers are: MCB Group, CIEL, Alteo Limited, SBM Holdings Ltd, Absa Bank (Mauritius) Ltd, The Mauritius Civil Service Mutual Aid Association Ltd, Investec Bank (Mauritius) Ltd, Standard Chartered Bank (Mauritius) Ltd, Larsen & Toubro and AfrAsia Bank Limited. Six banking institutions – compared to five last year – are ranked in the top 10 biggest profit makers.

MCB Group registered profit before tax of Rs 12.03 billion (increase of 26.8 per cent). CIEL, which was at the 9th position in last year’s ranking, secured the 2nd place this year with profit before tax reaching Rs 2.95 billion compared to Rs 772 million the previous year. Alteo Limited with profit before tax of 2.75 billion found itself at the 3rd place (8th place in last year’s ranking. SBM Holdings Ltd lost one place (4th in this present ranking) with profit before tax reaching Rs 2.17 billion, an increase of 65.8 per cent. Absa Bank (Mauritius), which was ranked at the 6th position last year, made its way to the 5th place with improved profit before tax of Rs 1.73 billion (increase of 61 per cent).

| Ranking | Company name | Profit before taxation | Financial year |

|---|---|---|---|

| 1 |

MCB Group

MCB Group Limited Tel: (230) 202 5000 Fax: (230) 208 0248 Email: contact@mcbgroup.com Website: www.mcbgroup.com Board Members

Chairman Didier Harel

Chief Executive Pierre Guy Noël MCB Group

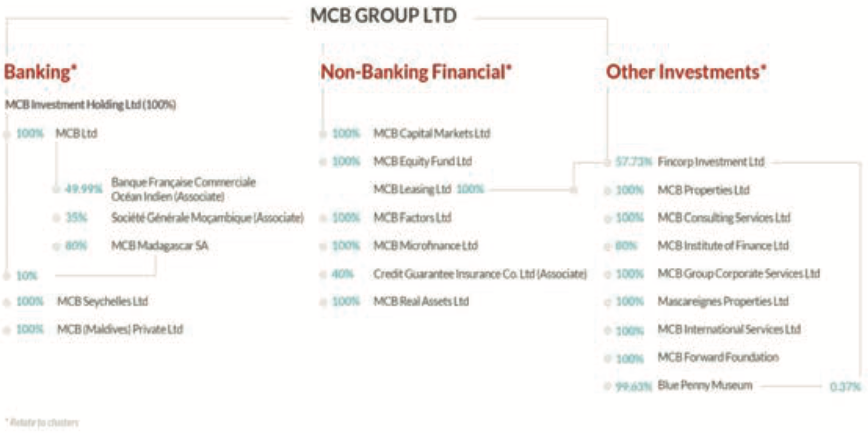

Total Assets: Rs 728,128 millionWith its 184-year history, MCB Group foreign subsidiaries and associates. MCB Group Ltd has evolved into a prominent regional acts as the ultimate holding company of the Group banking and financial services player, and the subsidiaries and associates thereof operate offering a comprehensive range of under three distinct clusters namely Banking, Non-tailored and innovative solutions through its local and Banking Financial and Other Investments. Group Structure

Established since 1838, MCB Ltd is the former holding company of the Group. It became a subsidiary of MCB Group Limited in 2014 after a corporate restructuring exercise that gave rise to the group structure set out above. It has cemented its position as the leading bank in Mauritius, in the process playing a key role in promoting the country’s socio-economic development. The Group initiated its expansion beyond domestic shores since the early 1990s and its presence abroad now spans 10 countries. It has dedicated banking subsidiaries in Madagascar, Seychelles and Maldives while being present in Reunion Island, Mayotte and France through its associate Banque Française Commerciale Océan Indien and Mozambique via its associate Société Générale Moçambique. Furthermore, MCB Ltd has established representative offices in Paris, Johannesburg and Nairobi as well as an advisory office in Dubai. The Group has widened and deepened its international involvement and continues to deploy its underlying growth agenda across Africa by focusing on targeted market segments where it has built expertise over time. Leveraging a wide network of correspondent banks, MCB Ltd is actively involved in cross-border deals and transactions mainly in sub-Saharan Africa. The Group has also diversified its activities into the non-banking field, offering a comprehensive range of investor-related services namely stockbroking, corporate finance advisory, investment management, register & transfer agent and private equity financing as well as leasing, factoring and micro-finance services. Besides, the organisation is reviewing its ‘Bank of Banks’ proposition and governance, to reinforce its position as a regional partner that provides tailored solutions to financial counterparts. The Group’s rich history, commitment to its clients, dedicated employees and innovative culture underpin its solid franchise and long track record of sustained profitability. During the past years, the Group has invested significantly in its Digital Transformation Programme to promote operational excellence and innovation as a key tenet to enhancing the quality of end-to-end customer experiences whilst enriching the appeal of its value proposition. MCB Ltd seeks to be the dominant digital bank in Mauritius through the rapid adoption and utilisation of its digital channels and solutions whilst accompanying the country in its transformation towards a cash-lite economy. As a responsible corporate citizen, the Group has endeavoured to achieve its corporate sustainability objectives by pursuing key initiatives revolving around three pillars namely: (i) the development of vibrant and sustainable local and regional economies; (ii) the preservation of our environmental and cultural heritage; and (iii) the promotion of individual and collective well- being. The organisation is developing an adapted sustainable finance framework as part of its aspiration to become a key sustainable finance player on the domestic and regional fronts. As part of the climate strategy set out by the Group, MCB Ltd aims to stop all new financing worldwide for coal infrastructure and trade as from 2022, in addition to contributing to carbon neutrality in its operations since 2018, through a mix of mitigation and offsetting actions. Furthermore, the Group adopted the MCB Gender Equality Charter, with the objective of fostering equal opportunity and fairness, work-life flexibility and a safe and respectful workplace. The shares of MCB Group Ltd are listed on the Official Market of the Stock Exchange of Mauritius since its inception in 1989. It has a large and diversified shareholder base with more than 22,000 local and foreign investors. Its market capitalisation, which is the largest on the local bourse, currently represents a share of above 27% based on SEMDEX. In addition, MCB Group Ltd forms part of the constituents of the Stock Exchange of Mauritius Sustainability Index (SEMSI) and is also awarded an MSCI ESG rating, both providing a benchmarking measure against a set of internationally environmental, social and governance criteria. Market Positioning By Cluster Banking Local MCB Ltd

Foreign involvement MCB Ltd

Overseas entities

Non-banking financial

Other investments

Credentials

Note that capital adequacy ratios are based on Basel III |

12,031.00 | 30 June 2022 |

| 2 |

CIEL

5th Floor, Ebene Skies, Tel: (230) 404 2200 Fax: (230) 404 2201 Email: info@cielgroup.com Website: www.cielgroup.com Directors

Chairman P. Arnaud Dalais

Group Chief Executive Jean-Pierre Dalais

Sébastien Coquard CIEL

Turnover: Rs 28.5 billionCIEL is an international Mauritian Group, listed on the Stock Exchange of Mauritius and on the SEM Sustainability Index. The Group invests and operates in 6 strategic sectors, namely:

Founded in 1912, CIEL is today present in more than 10 countries across Africa and Asia and employs 38,000 talented individuals. With a market capitalisation of about MUR 11.3 billion (USD 256 million) and a consolidated turnover of MUR 28.5 billion (USD 662 million) for the 12 months period ending 30 June 2022, CIEL is one of the largest listed Mauritian companies. As at 30th June 2022, its portfolio was valued at MUR 23.9 billion (USD 541 million). CIEL also partners with innovators and leaders in their respective fields:

BusinessesCIEL AgroCIEL is a key stakeholder in the agro- industry and owns 20.96% of Alteo Limited, a company listed on the Official Market of the Stock Exchange of Mauritius (SEM). With an annual turnover of MUR 12.1 billion in 2022 (approx. USD 281 million), Alteo is a leading regional player in the sugar, energy and property sectors. As the largest sugar producer in Mauritius and with a strong and growing presence in Africa, Alteo operates three sugar factories in Mauritius, Tanzania and Kenya with a total production of 301,927 tons of sugar and three power plants (two in Mauritius, one in Tanzania) that exported 258.9 GWh to the national grids in 2022. CIEL FinanceSpecialised in Banking & Financial Services, CIEL Finance Limited is a subsidiary of CIEL and is actively involved in 4 sub-sectors of the financial industry: Banking, Fiduciary, Asset Management and Stockbroking. With approx. 1,600 employees, CIEL Finance operates in Mauritius, Madagascar, Seychelles and Botswana. CIEL partnered with Amethis Finance, an investment vehicle dedicated to Africa, which currently owns a 24.9% stake in CIEL Finance. This partnership aims at creating synergies between the two groups and optimising their development in the banking & financial services sphere in sub-Saharan Africa and the Indian Ocean. IBL LTD : FINANCIAL HIGHLIGHTS - YEAR ENDED JUNE

C-CARE (INTERNATIONAL) LTDC-Care (International) Ltd is a registered private limited company which owns, operates and manage assets in the healthcare sector in Mauritius and across Uganda. C-Care currently holds majority stakes in C-Care (Mauritius) Ltd (67.41%), which owns and operates 2 main private healthcare facilities, namely C-Care Darné and C-Care Wellkin. C-Care also proposes laboratory services through C-Lab and has 2 satellites clinics across the island, C-Care Grand Baie and C-Care Tamarin. It also owns and manages the International Medical Group IMG (93.02%), largest provider of private healthcare services in Uganda. CIEL Hotels & ResortsCIEL Hotels & Resorts regroups all the tourism and hospitality activities of the Group. CIEL owns 50.10% of Sun Limited - a company listed on the Official Market of the Stock Exchange of Mauritius (SEM) and SEM Sustainability Index - which owns and operates four resorts in Mauritius (La Pirogue, Sugar Beach, Long Beach and Ambre), all operating in the four-to-five-star segments under the brand Sun Resorts. Sun Resorts also manages the iconic Ile aux Cerfs, off the East coast of Mauritius, which is comprised of the world-famous Bernhard Langer designed golf course. Besides, Sun Resorts owns 100% of the 5* luxury Four Seasons Resort Mauritius at Anahita which is managed by Four Seasons. Sun Ltd also owns 74% of the iconic Shangri-La's Le Touessrok Resort and Spa, managed by Shangri-La Hotels and Resorts since November 2015. Finally, CIEL, in joint venture with Alteo, also owns 50% of Anahita Residence & Villas Ltd, which is operating under the brand 'Anahita Golf and Spa Resort'. CIEL PropertiesCIEL Properties Limited looks after the Group's land and real estate assets in Mauritius. The property business includes Ferney Limited, an important landowner and manages a nature reserve and hunting grounds of (3,100 hectares) situated on the Southeast coast of Mauritius. Evolis, its latest property assets vehicle, is currently transforming old textile buildings and other properties of the Group into repurposed areas for commercial activities. With a strong focus on accelerating sustainable development in Mauritius, the Group offers differentiated biodiversity and agri-hub opportunities in the local market through La Vallée de Ferney. CIEL Properties also owns and manages Ebene Skies Limited, a six-level office building where CIEL is headquartered. CIEL TextileCIEL Textile is a world-class global player in textile and garments operations, present in Mauritius, Madagascar, India and Bangladesh with more than 23,000 employees. It has developed into a regional one-stop shop for textiles, with vertically integrated business units, from yarn spinning to finish garments. CIEL Textiles exports around 43 M garments annually to Europe, India, South Africa and USA. CIEL Textile's vision is to be the Best Global Fashion Partner with the objective to deliver unbeatable value to medium and upmarket retailers. ExecutivesGroup Chief Executive, CIELJean-Pierre Dalais Group Finance Director, CIELJérôme de Chasteauneuf Chief Executive Officer, CIEL TextileEric Dorchies Chief Executive Officer, Sun LimitedFrançois Eynaud Chief Executive Officer, CIEL FinanceLakshman Bheenick Chief Executive Officer,

|

2,985.27 | June 2022 |

| 3 |

Alteo Limited

Vivéa Business Park Tel: (230) 402 9050 Fax: (230) 432 0792 Email: info@alteogroup.com Website: www.alteogroup.com Facebook: www.facebook.com/alteogroup LinkedIn: www.linkedin.com/company/alteogroup Board of Directors

Chairman Jérôme de Chasteauneuf

Chief Executive Office Fabien de Marassé Enouf

Priscilla Balgobin-Bhoyrul Alteo

Turnover: Rs 12.1 billionListed on the Official Market of the Stock Exchange of Mauritius (SEM), Alteo is a regional group with well-established activities in the Sugar, Energy and Property sectors. Alteo is the largest sugar producer in Mauritius and has a strong presence in East Africa, where it operates two sugar factories in Tanzania and Kenya. In financial year 2021, the Group produced 297,900 tonnes of raw sugar and 65,000 tonnes of premium sugars. In addition to its sugar activities, Alteo owns and operates three power plants (two in Mauritius and one in Tanzania), that exported 205 GWh to the national grids in 2021. One of the Group’s core objectives is to expand its activities in the Energy sector, and to become a major player in renewable energy in Mauritius and East Africa. Over the last decade, Alteo has been diversifying into the Property sector through Anahita, a luxury residential and golf estate. Lately, the Group has been focusing on an ambitious strategic master planning exercise, with the ultimate aim of unlocking the value of its substantial land asset base, through the development of a variety of innovative real estate projects in the East of Mauritius. Alteo Ltd:

SUGAR*Mauritius (Alteo Agri Ltd, Alteo Milling Ltd and Alteo Refinery Ltd)

Tanzania (TPC Limited)

Kenya (Transmara Sugar Company Limited)

PROPERTY

Various real estate projects in the East of Mauritius. ENERGY*Mauritius (Alteo Energy Ltd and Helios Beau Champ Limited) and Tanzania (TPC Limited)- 205 GWh exported to the national grids * Figures for financial year 2021

|

2,751.00 | June 2022 |

| 4 |

SBM Holdings Ltd

SBM Tower Tel: (230) 202 1111 Fax: (230) 202 1234 Swift: STCBMUMU Email: sbm@sbmgroup.mu Website: www.sbmgroup.mu Directors

|

2,178.00 | 31 December 2021 |

| 5 |

Absa Bank (Mauritius Ltd)

Absa House Tel: (230) 402 1000 Email: customer.contact@absa.africa Website: absabank.mu

Managing Director Ravin Dajee Absa Bank (Mauritius) Limited

Total Assets: Rs 179,402 millionAbsa Bank (Mauritius) Limited is one of Mauritius' leading financial institutions offering an integrated set of products and services across corporate and investment banking, business banking with solutions for SMEs, and retail banking. Digitally- driven, leveraging its 100-year legacy on the island and its solid network on the African continent, Absa Mauritius is committed to being a partner of choice for its customers, with one main focus: “bringing possibilities to life”. A key contributor to socio-economic growth in Mauritius with several firsts to its name

Solid African network Absa Mauritius is part of Absa Group Limited which:

As a fully-fledged African bank with an international reach, and leveraging the country’s strategic location, Absa Mauritius is well positioned to address regional challenges and drive connectivity across key channels in UK/Europe, US and China, into and within Africa. Strategic goals the bank aims to achieve by 2023:

Values

Corporate and International Banking The Corporate and International Banking segment serves clients in the Domestic Large Corporates, International Large Corporates (including Global Corporates and Multinationals), Financial Institutions Group and Global Business Clients (licenced by the Financial Services Commission). Operating regionally and with a global footprint, its Business Model is designed around its clients’ needs to help them unleash the African potential. Absa brings the best of innovative solutions to its clients through tailor-made offerings, encompassing long- term debt financing, Cash and Liquidity Management, Trade and Working Capital, Custody services, Global Markets and FX, and Investment Banking services. Wealth International Wealth International offers banking services to non- resident private clients. Core products include:

Business Banking Business Banking services are tailored to the following clients:

Global Markets Global Markets offers include:

Retail Banking Retail Banking provides financial solutions including - but not limited to - loans, deposits and cards to five customer segments: Personal, Young Pro, Prestige, Premier and Wealth Onshore. Several novel digital channels are also in place to offer customers a seamless banking experience. The business’ physical network includes three Premier lounges, nine branches and 40 ATMs. A responsible approach to society Absa Mauritius recognises the importance of embedding environmental, social and governance (ESG) factors more firmly in its culture, business strategy and how it operates. The bank’s ESG agenda is based on three pillars: sustainable banking practices, responsible corporate behaviours and corporate social responsibility (CSR) initiatives. Absa Mauritius reiterates its commitment to be an active force for good and to create a sustainable tomorrow for all its stakeholders – employees, customers, shareholders and the community. Absa Mauritius is aligned with Absa Group’s vision to creating sustainable and value-added solutions to some of Africa’s greatest environmental challenges. The Group:

Most recent accolades

|

1,733.00 | 31 December 2021 |