Ranking by sector

Banking

Banking sector assets continued to expand

The banking system continued to hold the major share of the The growing credit portfolio (excluding GBCs) of banks financial market. The composition of the banking industry contributed primarily to the expansion of banking assets, indicative was unchanged, with nineteen banks licensed to carry on of sustained confidence in the banking sector and in economic banking business in Mauritius as at end December 2021, recovery prospects. Banks also balanced their risk-taking business of which six were domestic-owned, ten were foreign-owned and through continuous investment in less risky assets, notably three were branches of foreign banks.

Read more

Banking sector assets continued to expand

The banking system continued to hold the major share of the The growing credit portfolio (excluding GBCs) of banks financial market. The composition of the banking industry contributed primarily to the expansion of banking assets, indicative was unchanged, with nineteen banks licensed to carry on of sustained confidence in the banking sector and in economic banking business in Mauritius as at end December 2021, recovery prospects. Banks also balanced their risk-taking business of which six were domestic-owned, ten were foreign-owned and through continuous investment in less risky assets, notably three were branches of foreign banks.

Banking sector assets continued to expand

The banking system continued to hold the major share of the The growing credit portfolio (excluding GBCs) of banks financial market. The composition of the banking industry contributed primarily to the expansion of banking assets, indicative was unchanged, with nineteen banks licensed to carry on of sustained confidence in the banking sector and in economic banking business in Mauritius as at end December 2021, recovery prospects. Banks also balanced their risk-taking business of which six were domestic-owned, ten were foreign-owned and through continuous investment in less risky assets, notably three were branches of foreign banks.

Banking sector assets continued to expand

The banking system continued to hold the major share of the The growing credit portfolio (excluding GBCs) of banks financial market. The composition of the banking industry contributed primarily to the expansion of banking assets, indicative was unchanged, with nineteen banks licensed to carry on of sustained confidence in the banking sector and in economic banking business in Mauritius as at end December 2021, recovery prospects. Banks also balanced their risk-taking business of which six were domestic-owned, ten were foreign-owned and through continuous investment in less risky assets, notably three were branches of foreign banks.

|

Ranking 2022 |

Ranking 2021 |

Company name | Total assets 2021 | Profit/Loss 2021 | Total assets 2022 | Profit/Loss 2022 | Financial year |

|---|---|---|---|---|---|---|---|

| 1 | 1 |

MCB Group

MCB Group Limited Tel: (230) 202 5000 Fax: (230) 208 0248 Email: contact@mcbgroup.com Website: www.mcbgroup.com Board Members

Chairman Didier Harel

Chief Executive Pierre Guy Noël MCB Group

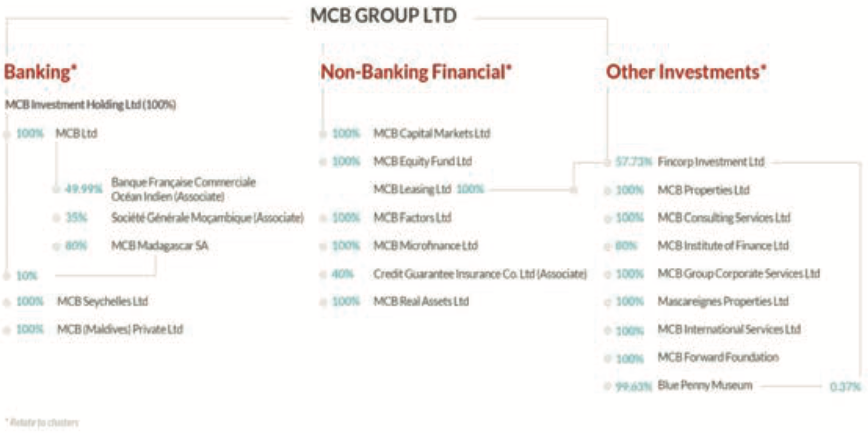

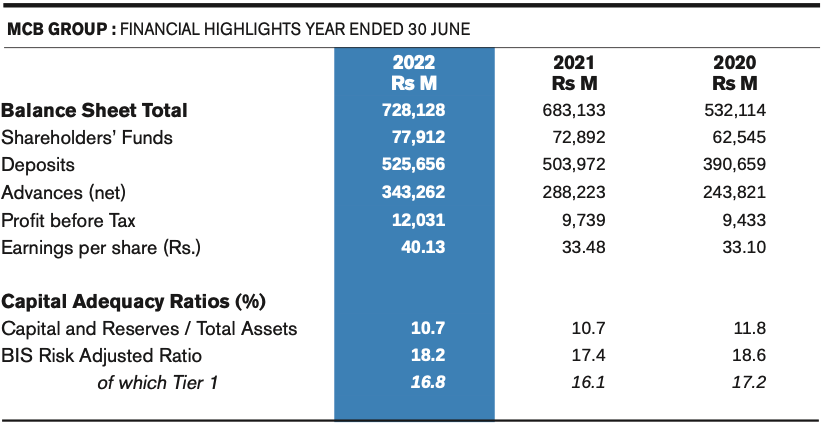

Total Assets: Rs 728,128 millionWith its 184-year history, MCB Group foreign subsidiaries and associates. MCB Group Ltd has evolved into a prominent regional acts as the ultimate holding company of the Group banking and financial services player, and the subsidiaries and associates thereof operate offering a comprehensive range of under three distinct clusters namely Banking, Non-tailored and innovative solutions through its local and Banking Financial and Other Investments. Group Structure

Established since 1838, MCB Ltd is the former holding company of the Group. It became a subsidiary of MCB Group Limited in 2014 after a corporate restructuring exercise that gave rise to the group structure set out above. It has cemented its position as the leading bank in Mauritius, in the process playing a key role in promoting the country’s socio-economic development. The Group initiated its expansion beyond domestic shores since the early 1990s and its presence abroad now spans 10 countries. It has dedicated banking subsidiaries in Madagascar, Seychelles and Maldives while being present in Reunion Island, Mayotte and France through its associate Banque Française Commerciale Océan Indien and Mozambique via its associate Société Générale Moçambique. Furthermore, MCB Ltd has established representative offices in Paris, Johannesburg and Nairobi as well as an advisory office in Dubai. The Group has widened and deepened its international involvement and continues to deploy its underlying growth agenda across Africa by focusing on targeted market segments where it has built expertise over time. Leveraging a wide network of correspondent banks, MCB Ltd is actively involved in cross-border deals and transactions mainly in sub-Saharan Africa. The Group has also diversified its activities into the non-banking field, offering a comprehensive range of investor-related services namely stockbroking, corporate finance advisory, investment management, register & transfer agent and private equity financing as well as leasing, factoring and micro-finance services. Besides, the organisation is reviewing its ‘Bank of Banks’ proposition and governance, to reinforce its position as a regional partner that provides tailored solutions to financial counterparts. The Group’s rich history, commitment to its clients, dedicated employees and innovative culture underpin its solid franchise and long track record of sustained profitability. During the past years, the Group has invested significantly in its Digital Transformation Programme to promote operational excellence and innovation as a key tenet to enhancing the quality of end-to-end customer experiences whilst enriching the appeal of its value proposition. MCB Ltd seeks to be the dominant digital bank in Mauritius through the rapid adoption and utilisation of its digital channels and solutions whilst accompanying the country in its transformation towards a cash-lite economy. As a responsible corporate citizen, the Group has endeavoured to achieve its corporate sustainability objectives by pursuing key initiatives revolving around three pillars namely: (i) the development of vibrant and sustainable local and regional economies; (ii) the preservation of our environmental and cultural heritage; and (iii) the promotion of individual and collective well- being. The organisation is developing an adapted sustainable finance framework as part of its aspiration to become a key sustainable finance player on the domestic and regional fronts. As part of the climate strategy set out by the Group, MCB Ltd aims to stop all new financing worldwide for coal infrastructure and trade as from 2022, in addition to contributing to carbon neutrality in its operations since 2018, through a mix of mitigation and offsetting actions. Furthermore, the Group adopted the MCB Gender Equality Charter, with the objective of fostering equal opportunity and fairness, work-life flexibility and a safe and respectful workplace. The shares of MCB Group Ltd are listed on the Official Market of the Stock Exchange of Mauritius since its inception in 1989. It has a large and diversified shareholder base with more than 22,000 local and foreign investors. Its market capitalisation, which is the largest on the local bourse, currently represents a share of above 27% based on SEMDEX. In addition, MCB Group Ltd forms part of the constituents of the Stock Exchange of Mauritius Sustainability Index (SEMSI) and is also awarded an MSCI ESG rating, both providing a benchmarking measure against a set of internationally environmental, social and governance criteria. Market Positioning By Cluster Banking Local MCB Ltd

Foreign involvement MCB Ltd

Overseas entities

Non-banking financial

Other investments

Credentials

Note that capital adequacy ratios are based on Basel III |

728,128.00 | 728,128.00 | 9,739.00 | 9,739.00 | 30/06/22 |

| 2 | 2 |

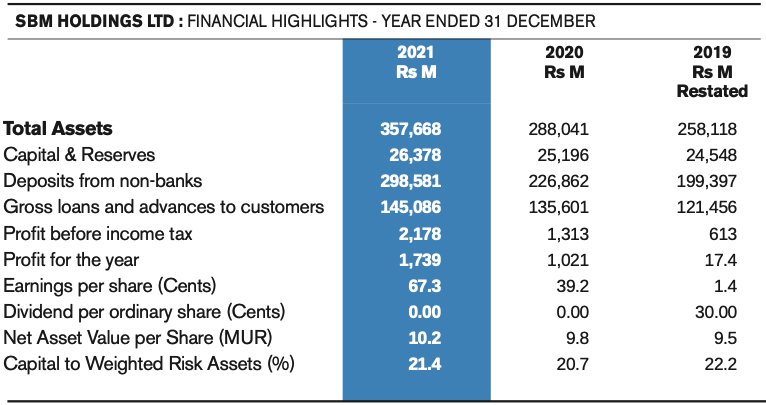

SBM Holdings Ltd

SBM Tower Tel: (230) 202 1111 Fax: (230) 202 1234 Swift: STCBMUMU Email: sbm@sbmgroup.mu Website: www.sbmgroup.mu Directors

|

357,668.00 | 357,668.00 | 1,313.00 | 1,313.00 | 31/12/21 |

| 3 | 3 |

Afrasia Bank Limited

Bowen Square Tel: (230) 208 5500 Fax: (230) 213 8850 Email: afrasia@afrasiabank.com Website: www.afrasiabank.com Board of Directors

Interim CEO Thierry Vallet Leadership TeamInterim CEO Thierry Vallet CFO & Executive Director Thierry Vallet Management Team

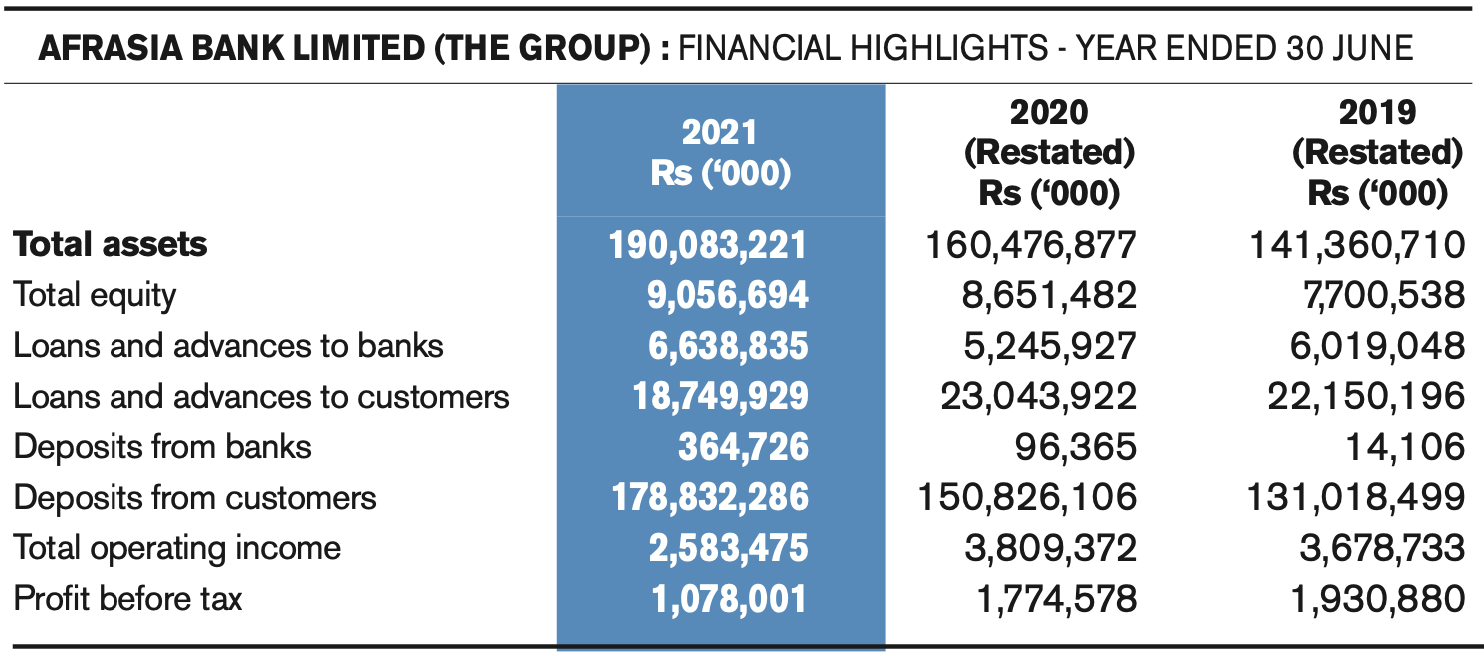

AfrAsia Bank Limited

Total Assets: Rs 190,083 millionHeadquartered in the Mauritius International Financial Centre, with distinct expertise and ability to serve clients in more that 160 countries, AfrAsia Bank bridges Africa, Asia, Europe and the World. The Bank develops banking solutions geared in four core divisions:

In addition to its anchor Mauritian shareholder, IBL Ltd – the largest conglomerate in the country – strong strategic partners include National Bank of Canada, one of the six systemically important banks in Canada, and Intrasia Group. AfrAsia Bank’s core banking and transactional capabilities are also established in the South Africa jurisdiction via its representative office in Johannesburg. Corporate Banking Corporate Banking offers a comprehensive range of innovative short-term and long-term funding solutions which include:

AfrAsia Bank also participates in cross-border syndicated loans with international banks covering a range of markets and industries. The Bank offers cash management services, including multi-currency deposits, and covers a wide spectrum of other services such as mergers and acquisitions, restructuring, strategic advice, and specialised finance. Treasury & Markets Through its Treasury & Markets arm, AfrAsia Bank assists in treasury capabilities for corporates and individuals including:

Private Banking & Wealth Management AfrAsia Bank provides a bespoke offer to both high-net-worth residents and non-residents and offers its clients the resulting benefits of its efficient, prompt and global reach. Since inception, AfrAsia Bank has bagged several awards from prestigious magazines including Euromoney, The Banker, African Banker and EMEA Finance. The range of differentiated products and services includes:

Global Business Banking With customers on all continents, AfrAsia Bank has the ability to provide its clients with innovative products and services, and is serving the international corporate, asset management, and private banking markets, while using Mauritius as an International Financial Centre. The Bank has regional and international cross-border capabilities to deliver tailor-made solutions with tangible benefits in an environment of trust. The Bank is also a partner in helping private and corporate clients benefit from Mauritius’ network of Double Taxation Agreements (DTAs) and its membership to SADC and COMESA. Global Business Banking Solutions includes:

Accolades 2022

2021

2020

|

190,083.00 | 190,083.00 | 1,774.57 | 1,774.57 | 30/06/21 |

| 4 | 4 |

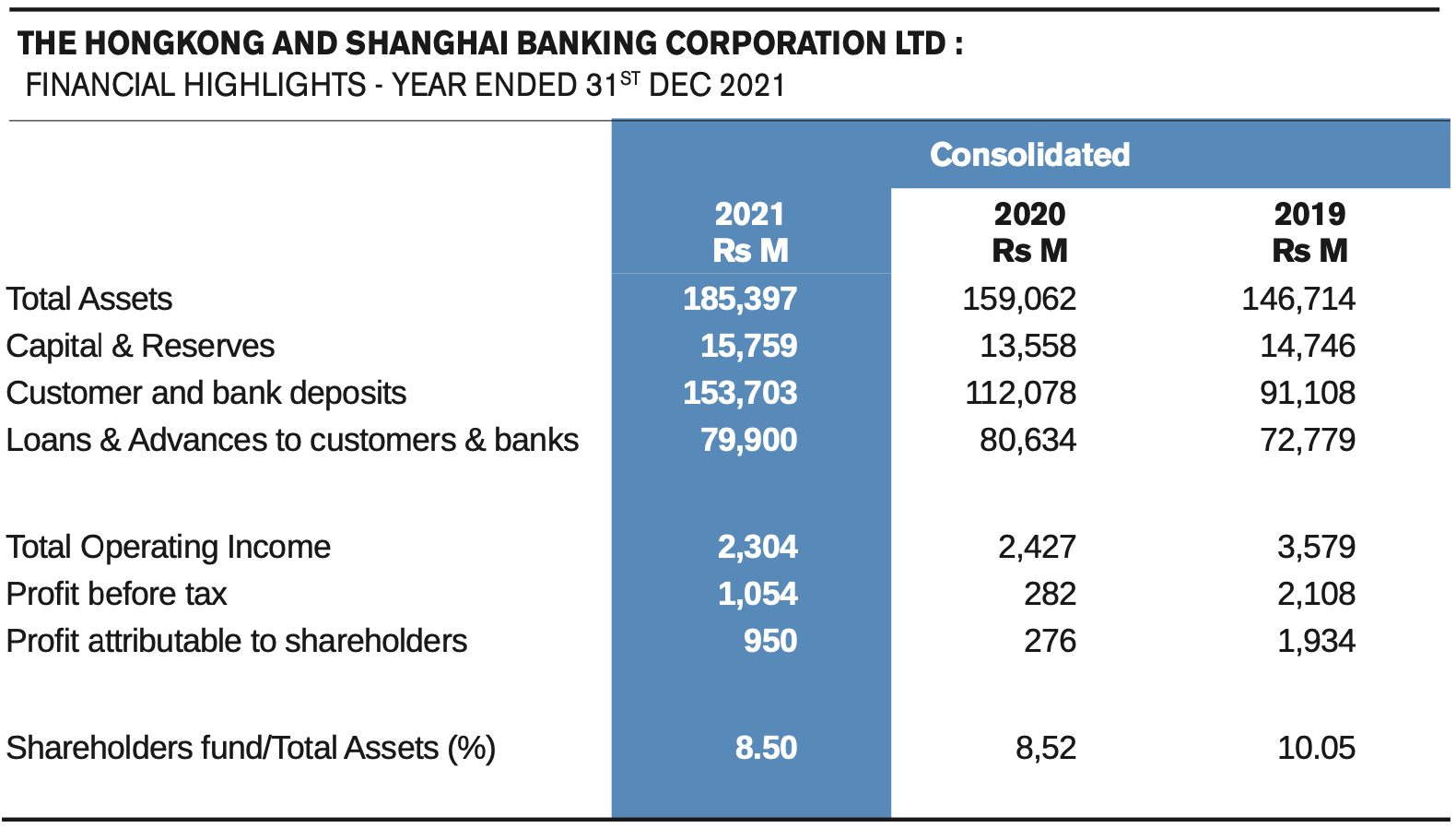

The Hongkong and Shanghai Banking Co. Ltd

HSBC Mauritius has its Tel: (230) 403 8333 Chief Executive Officer Bonnie Qiu HSBC Bank (Mauritius) Limited Tel: (230) 403 8333 Managing Director Dean Lam Management TeamChief Executive Officer Bonnie Qiu Interim Chief Executive Officer Sarina Saul-Hassam Chief Finance Officer Rajiv Gopaul Head of Wealth and Personal Banking Nitin Ramlugon Head of Markets and Securities Services Vassan Caleemootoo Managing Director HSBC Bank (Mauritius) Ltd & Head of Wholesale Banking Dean Lam Chief Compliance Officer Ashish Gowreesunker Head of Human Resources Rim Abohegab Head of Legal and Company Secretary Ashiti Prosand The Hongkong and Shanghai Banking Corporation Ltd

Total Assets: Rs 185,397 millionHSBC has two entities in Mauritius — a branch of The Hongkong and Shanghai Banking Corporation Ltd and a local subsidiary, HSBC Bank (Mauritius) Limited. The Bank operates six retail branches which provide a range of consumer banking services from account opening, to mortgage, personal loans, credit card offerings with enhanced security features and instant payments via its digital platforms. Through HSBC Bank (Mauritius) Limited, the local subsidiary offers global banking services which include: Corporate Banking Dedicated corporate account relationship ma- nagers tailor services to customer requirements in corporate facilities and funding, and short and long- term funding in local and foreign currencies. Global Business One of the first banks to set up an Offshore Banking Unit in Mauritius in 1991, HSBC has grown to be one of the leading banks in the Mauritius Global Business sector. Its clients enjoy a comprehensive range of trade services, finance and facilities, catering particularly to the needs of Freeport, trade and global business companies operating from Mauritius. HSBC’s financial products and solutions offered to meet the requirements of global inves- tors include:

|

185,397.00 | 185,397.00 | 282.00 | 282.00 | 31/12/21 |

| 5 | 5 |

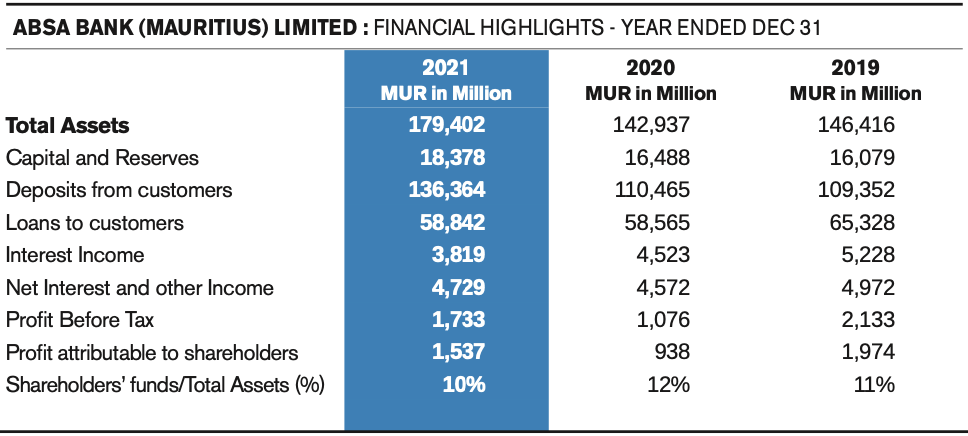

Absa Bank (Mauritius Ltd)

Absa House Tel: (230) 402 1000 Email: customer.contact@absa.africa Website: absabank.mu

Managing Director Ravin Dajee Absa Bank (Mauritius) Limited

Total Assets: Rs 179,402 millionAbsa Bank (Mauritius) Limited is one of Mauritius' leading financial institutions offering an integrated set of products and services across corporate and investment banking, business banking with solutions for SMEs, and retail banking. Digitally- driven, leveraging its 100-year legacy on the island and its solid network on the African continent, Absa Mauritius is committed to being a partner of choice for its customers, with one main focus: “bringing possibilities to life”. A key contributor to socio-economic growth in Mauritius with several firsts to its name

Solid African network Absa Mauritius is part of Absa Group Limited which:

As a fully-fledged African bank with an international reach, and leveraging the country’s strategic location, Absa Mauritius is well positioned to address regional challenges and drive connectivity across key channels in UK/Europe, US and China, into and within Africa. Strategic goals the bank aims to achieve by 2023:

Values

Corporate and International Banking The Corporate and International Banking segment serves clients in the Domestic Large Corporates, International Large Corporates (including Global Corporates and Multinationals), Financial Institutions Group and Global Business Clients (licenced by the Financial Services Commission). Operating regionally and with a global footprint, its Business Model is designed around its clients’ needs to help them unleash the African potential. Absa brings the best of innovative solutions to its clients through tailor-made offerings, encompassing long- term debt financing, Cash and Liquidity Management, Trade and Working Capital, Custody services, Global Markets and FX, and Investment Banking services. Wealth International Wealth International offers banking services to non- resident private clients. Core products include:

Business Banking Business Banking services are tailored to the following clients:

Global Markets Global Markets offers include:

Retail Banking Retail Banking provides financial solutions including - but not limited to - loans, deposits and cards to five customer segments: Personal, Young Pro, Prestige, Premier and Wealth Onshore. Several novel digital channels are also in place to offer customers a seamless banking experience. The business’ physical network includes three Premier lounges, nine branches and 40 ATMs. A responsible approach to society Absa Mauritius recognises the importance of embedding environmental, social and governance (ESG) factors more firmly in its culture, business strategy and how it operates. The bank’s ESG agenda is based on three pillars: sustainable banking practices, responsible corporate behaviours and corporate social responsibility (CSR) initiatives. Absa Mauritius reiterates its commitment to be an active force for good and to create a sustainable tomorrow for all its stakeholders – employees, customers, shareholders and the community. Absa Mauritius is aligned with Absa Group’s vision to creating sustainable and value-added solutions to some of Africa’s greatest environmental challenges. The Group:

Most recent accolades

|

179,402.00 | 179,402.00 | 1,076.00 | 1,076.00 | 31/12/21 |